Beginner’s Guide to Forex Trading Step-by-Step Insights

Welcome to Forex Trading: A Beginner’s Journey

Forex trading is increasingly popular among individuals looking to earn money online. For those just starting, the learning curve can seem daunting, but with the right guidance and resources, anyone can become a proficient trader. Understanding the fundamentals of the Forex market is crucial for success. This article serves as a comprehensive guide for beginners to navigate the complexities of forex trading. Along the way, we will also introduce various resources, including beginner forex trading Trading Brokers in Vietnam, to help enhance your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, refers to the marketplace where currencies are traded. Unlike stocks or commodities, the Forex market operates 24 hours a day, five days a week, and involves buying one currency while simultaneously selling another. The primary goal is to profit from changes in the exchange rates between these currencies.

Key Terminology

Before diving into trading, it’s essential to familiarize yourself with some key terms:

- Currency Pair: Currencies are traded in pairs, such as EUR/USD or USD/JPY, indicating the price of one currency in terms of another.

- Pip: Short for “percentage in point,” a pip is a unit of measurement that indicates the smallest price change in a currency pair.

- Leverage: This allows traders to control larger positions with a smaller amount of capital, amplifying both potential gains and risks.

- Spread: The gap between the buying (ask) price and the selling (bid) price of a currency pair.

Getting Started with Forex Trading

To embark on your Forex trading journey, follow these essential steps:

1. Education

Knowledge is power in Forex trading. Begin by educating yourself on market mechanics, trading strategies, and the economic factors that influence currency prices. Resources such as webinars, eBooks, and online courses can provide valuable insights.

2. Choosing a Broker

Selecting the right broker is crucial. Look for a broker that offers a user-friendly platform, competitive spreads, and robust customer service. Also, ensure that the broker is regulated, providing a level of safety for your investments.

3. Opening a Trading Account

Once you have chosen a broker, you will need to open a trading account. Most brokers offer different account types tailored to various trading needs. Start with a demo account to practice trading without risking real money, allowing you to gain confidence before placing live trades.

4. Developing a Trading Strategy

A solid trading strategy will help you make informed decisions. Consider your trading goals, risk tolerance, and market analysis methods. Common strategies include technical analysis, fundamental analysis, and a combination of both.

5. Risk Management

Understanding how to manage risk is vital in Forex trading. Never risk more than you can afford to lose. Use stop-loss orders to limit potential losses and maintain a trading plan to help keep emotions in check.

Technical Analysis vs. Fundamental Analysis

Traders often rely on two main types of analysis to make trading decisions: technical analysis and fundamental analysis.

Technical Analysis

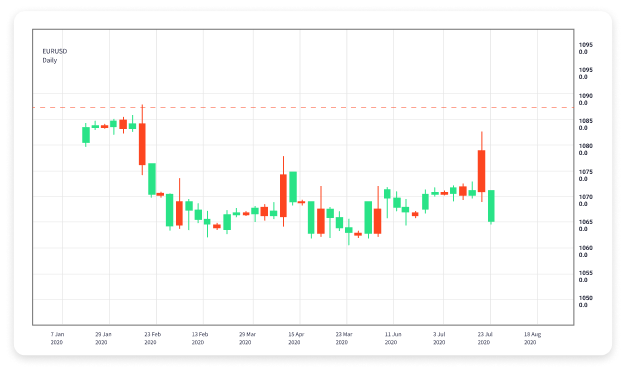

Technical analysis involves analyzing historical price movements and using various tools such as charts, patterns, and indicators to predict future price movements. Key tools include moving averages, relative strength index (RSI), and Fibonacci retracement levels.

Fundamental Analysis

Fundamental analysis focuses on the economic indicators and news events that affect currency prices. This includes interest rates, employment reports, and geopolitical events. Understanding these factors helps traders gauge the strength or weakness of a currency.

Creating a Trading Plan

A well-defined trading plan is essential for successful trading. Your plan should outline your trading goals, risk tolerance, time commitment, and entry and exit strategies. Regularly review and adjust your plan based on performance and market conditions.

Emotional Discipline in Trading

Emotions can significantly impact trading decisions, often leading to impulsive actions. Maintaining emotional discipline is critical for traders to stick to their trading plans and avoid unnecessary losses. Techniques such as journaling trades, setting realistic expectations, and taking breaks can help in managing emotional responses.

Continuing Your Education

The Forex market is constantly evolving, making continuous education essential. Participate in trading communities, follow market news, and read up on new strategies to stay updated. Consider joining Forex forums or trading groups where you can share experiences and gain insights from seasoned traders.

Conclusion

Forex trading offers exciting opportunities but also entails significant risks. Beginners must equip themselves with knowledge, choose a reliable broker, and develop a solid trading strategy. By maintaining discipline and continuously educating themselves, new traders can increase their chances of success in the Forex market. Whether you trade for a hobby or as a way to earn an income, patience and perseverance are key in this challenging but rewarding environment.