Checking Membership: Discover On line Now

Blogs

By mid-March, there is however no verified day to possess whenever this type of checks usually getting brought. Governor Hochul has said one to while the monitors are essential, its distribution relies on the fresh approval and you will finalization of the county finances. If all of the happens based on plan, the original costs you may beginning to become spreading in the fall away from 2025, but so it remains conditional on legislative acceptance.

Rental Rights Walk-Within the Services

Age. But because the given inside the subsection D, no lease needed to end up being escrowed below so it section might be disbursed within ten days of the fresh date of your view unless or even wanted to from the parties. If the an appeal is actually drawn by the plaintiff, the brand new book held within the escrow will likely be carried to the clerk of the circuit legal as stored in such judge escrow account pending the outcomes of your own interest. B. The newest landlord shall carry out the obligations imposed from the subsection A good inside the accordance with rules; but not, the new landlord will just be liable for the newest tenant’s actual problems proximately because of the fresh landlord’s incapacity to exercise normal care and attention. E. Zero nonresident resident shall take care of a hobby from the courts of one’s Commonwealth about the property by which a good designation is needed through this point up to including designation could have been registered. D. The name and you can office address of one’s broker appointed as the considering within point might be listed on a type provided by the official Business Payment and you may brought to the office of the clerk of your County Corporation Payment for processing. Delivery July step one, 2022, the fresh clerk of the Condition Firm Percentage should charge you away from $ten to the processing of a citizen representative meeting.

If your property owner doesn’t found a response on the creator of your own report inside three business days from asking for all the information, the new property manager could possibly get go-ahead having with the advice from the statement as opposed to a lot more step. B. In case your property owner fails to supply the notice necessary for so it area, the newest tenant will have the to cancel the newest leasing contract abreast of created observe for the landlord no less than five working days prior to the active date away from termination. In case your renter terminates the new leasing contract, the newest landlord should create feeling of your own tenant’s defense put inside the conformity that have laws or the specifications of one’s rental contract, any kind of applies. If your occupant would like to be present in the event the property owner produces the new assessment, the guy should, on paper, so advise the brand new property manager, just who therefore should alert the newest renter of the time and you can time of the inspection, which should be produced within 72 instances out of delivery away from arms. After the flow-away review, the newest landlord shall deliver the tenant with a created security put mood declaration, along with an enthusiastic itemized listing of problems. B. Any occupant who’s not given the new revelation required by subsection A could cancel the brand new lease arrangement at any time within sixty times of finding of one’s life out of defective drywall giving created see on the property manager in accordance with the lease or as needed legally.

College or university region term and you may password number

Whilst the provincial area of the HST isn’t payable whenever you transfer commercial things that is condemned on the playing provinces, the products can be susceptible to mind-evaluation of your provincial the main HST once they is delivered on the a good using state. Anyone accountable for make payment on GST/HST to the imported items is the people accountable for paying the culture responsibility, otherwise who would become in control should your products were at the mercy of duty. The brand new CRA can also require usage of foreign-centered information otherwise info handled otherwise found outside Canada we need to give the new GST/HST. So you can assess your own instalment costs and find out the new relevant payment dates, go to My Company Membership or Portray a person. If you publish your own go back by the mail, we take into account the day of one’s postmark becoming the fresh go out i received it.

A typical method to sign up a card connection that is available to someone should be to build a little contribution to become listed on a team or organization. Such as, if a credit partnership inside Georgia only has branches for the reason that state and provides an out in- website link person-just IRA Video game or IRA certification, you are probably from luck if you live within the California. Quorum Government Borrowing from the bank Connection could be a smart choice when you’re searching for a zero-commission, high-desire savings account otherwise label membership. Quorum’s identity accounts are like Dvds and you will have nine name options. Quorum are seemed within finest Cd rates book, however, with respect to the identity, you’ll find higher prices somewhere else.

Along with, you ought to enter the federal preparer tax personality amount (PTIN) for those who have one to; or even, you should enter your Public Shelter matter. If you pay people to ready your come back, the newest repaid preparer must also signal it and fill in the new other blanks in the repaid preparer’s area of your own go back. A person who prepares the go back and will not charge a fee ought not to complete the brand new paid back preparer’s area. To avoid focus and punishment charge, you need to document their get back and you may pay the total count you are obligated to pay from the April 15, 2025.

Colorado Rental Advice Apps

- Family with college students will get deal with highest fitness-worry will set you back and you will shorter entry to health care based on how says respond to federal investing incisions proposed from the Family Republicans, with regards to the Target Budget and Plan Goals.

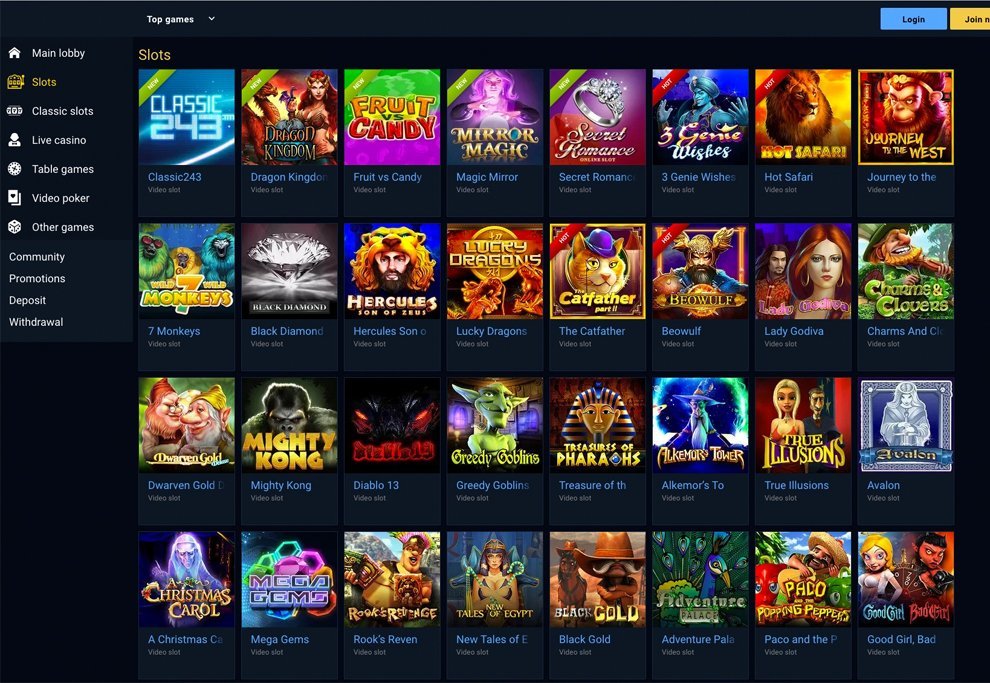

- Top Coins is a superb program to have online slots games having loads from preferred preferred and invisible treasures.

- On the directory of all relevant GST/HST prices, check out GST/HST calculator (and rates).

- The first is it is no longer needed to establish one’s financial solvency, and therefore before must be exhibited through in initial deposit from $5,one hundred thousand inside the a lender.

- It usually is their duty to confirm your money is obtainable in your bank account just before spending them.

Other borrowing from the bank unions you will provide marketing or certified bank account one to are merely available to professionals who meet particular conditions. Such, in the event the a credit connection also offers a family savings for kids, you actually will not be able to discover it on your own when the you’re 35. That which you’ll have to look out for is the month-to-month non-refundable percentage you can even become spending. These charges merely wade to the improving the assets shell out its insurance rates and also you nevertheless can be recharged cash on move-out for the injuries.

The brand new chip can’t be directly regarding the new low-resident holder of one’s brought in items to be canned and should not has possession demand for the new brought in merchandise or even the canned points. The goods must be exported of Canada in this few years out of the new go out they were stated and taken into account to your importation. If you aren’t an excellent GST/HST registrant, you can’t claim ITCs on the GST or the federal area of your own HST you pay in the course of importation. However, if the a consumer are a great GST/HST registrant, the client may be able to allege ITCs. To find out more, find Move-thanks to away from ITCs and you may GST/HST Plan Declaration P-125R, Enter in Taxation Credit Entitlement for Income tax for the Imported Items. Once you document your GST/HST return at the conclusion of the new fiscal 12 months, deduct the fresh instalment costs you have made all year round from the online income tax your debt on line 110 of your own come back.

The radio vendor as well as the inspector invoice you due to their possessions and you can services. Functions in respect of products otherwise real property is no-rated in case your features are offered in order to a low-citizen that is not inserted under the regular GST/HST regimen to fulfill an obligation lower than a guarantee provided by a low-resident person. It point shows you how GST/HST relates to brought in characteristics and you can intangible private assets (IPP) gotten external Canada, for use, have fun with or also have inside Canada.

“Our company is deciding on a genuine union of your organization to help you suffice this group,” told you DeFilippi. “To obtain the designation, you will want to make sure your rules as well as your tips is actually welcoming and you may do allow people, no matter their immigration position to open an account and have availableness borrowing.” Folks need access to reasonable banking devices and you can features no matter of their citizenship otherwise immigration reputation.

Criteria for selecting a lender

Related persons is someone connected by the bloodstream dating, wedding, common-law relationship, courtroom use otherwise adoption actually. A firm plus one person otherwise two organizations can be relevant people. Concurrently, to have GST/HST objectives, a member from a partnership resembles the relationship. The overall game lobby is actually finest-organized and you may stating gambling enterprise Resident the fresh informal record-within the additional is simple. Half dozen the newest alive gambling games make RealPrize you to of the uncommon societal gambling enterprises with real time somebody.