A Beginner’s Guide to Hyperliquid Hype Decentralized Continuous Change

You can now provide liquidity for those vaults and certainly will show proportionally regarding the profit-and-loss (PNL) according to per depositor’s show of your own vault. More interesting pieces lay regarding the opinion mechanism and you may digital server. Whilst margining and you will exchange costs really are a center element, we’ll protection her or him inside a later on area. Alex Costa is a great crypto writer and trader focusing on researching, considering and you may reporting on the guaranteeing quick-limit plans that are gaining grip in the industry. He has held it’s place in crypto while the 2018, when he began looking for invisible jewels inside the crypto.

An amateur’s Guide to LLMs to have Crypto Lookup: hyperliquid

Simultaneously, as opposed to really airdrops, the cost of the newest token have appreciated, partially due to the the latter circumstances. There have been two process vaults on the Hyperliquid, the fresh Hyperliquidity Vendor (HLP) and you may Liquidator vaults. Both the HLP and you will Liquidator vaults try neighborhood-had and you may enshrined in the protocol.

Aster Overtakes Hyperliquid Within the Each day DEX Exchange That have $793 Million Volume

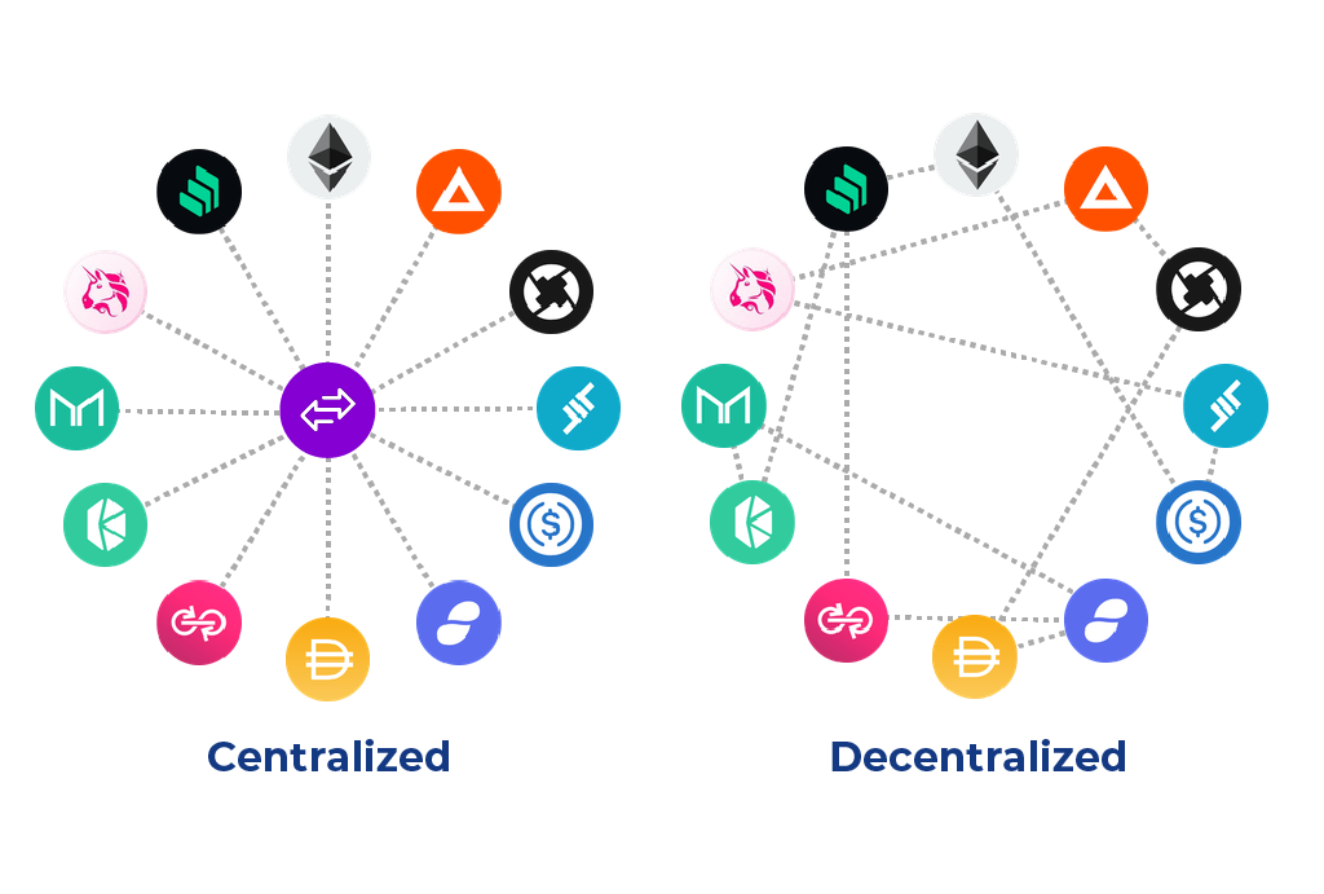

For every CoinGecko investigation, Hyperliquid’s $609 million in the twenty four-hr regularity leaves it from the seventh lay one of many DEXs, while you are Aster consist during the 8th put which have $583 million within the twenty four-hour frequency. The group has been around the space since the 2020 (started out as the industry producers) however, was in the future (unsurprisingly) amazed during the not enough an actual UX to have users within the the market. The brand new Hyperliquid exchange supporting an extensive directory of tokens along with AVAX, BNB, BTC, CRV, ETH, FTM, MATIC, SUI, and more. And that i imagine sincere and you may perseverant builders regarding the place had been heading extinct. Record holds witness to the powerful importance of transfers, of modest peer-to-fellow bartering to help you to be foundations from around the world financial ecosystems. But really, the newest downside is dependant on the centralization, concentrating power in the hands away from a small number of.

For example a design are quicker decentralized than simply a completely to the-chain DEX, causing centralization inquiries one of particular users. That have effortless bag partnership and you can no fuel charge, is great for buyers who wish to benefit from unpredictable locations. Prior to We reveal just what Hyperliquid are, in some words they shines because the an innovative platform that combines the rate and convenience of main exchanges (CEX) on the defense away from decentralized (DEX).

- So it event has raised issues about the brand new visibility and decentralization out of the platform, with many wondering whether including decisions you’ll jeopardize the brand new trust out of users.

- So it procedure incentivizes early contribution if you are making sure exchangeability thresholds try satisfied.

- The fresh Hyperliquid group often in public places emphasizes the possibility produced reject people exterior investment, don’t have any paid off industry producers, and you can shell out no charges to virtually any enterprises.

- Within the a packed field out of DEXs such as GMX, dYdX, and you may Jupiter Perps, Hyperliquid’s crossbreed model and you may individualized-centered blockchain provide a distinct advantage.

- Zhao indicated to help you features for example undetectable requests, which permit users to place deals as opposed to launching the ranks in order to the whole circle.

This approach guarantees usage of a hyperliquid considerably broader set of change pairs and deeper liquidity pools, making OKX DEX a functional choice for buyers of all of the choices. Because of the consolidating exchangeability of certain source, OKX DEX have a tendency to provides premium rates performance, straight down slippage, and increased trading options even for assets with down industry request or even more volatility. Hyperliquid’s robust system and you can cutting-border tech encourage it to cope with an astounding 200,100 purchases for every second. So it unmatched scalability implies that the working platform is also manage its highest performance and simply complement a rise inside member pastime even throughout the attacks from top demand.

- Productivity for the exchanging away from crypto property may be subject to income tax, as well as funding growth taxation, on your jurisdiction.

- This really is while less than 30 days have introduced as the checklist.

- That it gains has been supported because of the Bitcoin’s surge prior $105,one hundred thousand and you can a wider field upswing, having Hyperliquid trapping 70% of your to your-chain perpetual futures market.

- Which bridge encourages safer places and distributions, requiring the fresh approval of a couple-thirds of one’s staking capability to execute such purchases.

The newest method sets the new default margin so you can cross-margin to allow the application of guarantee across the multiple get across-margin positions. Furthermore, on account of signed-supply password and a centralized API, validators find of a lot troubles conducive to inconsistent efficiency and you can repeated jailing from nodes. Following this tolerance are reached, one entity or group can be stop the fresh strings. In the event the an entity otherwise class retains dos/step 3 of your circle, they can manage the fresh strings completely. A similar number of validators since the L1 protects the fresh link that have a threshold procedure.

Smart Agreements

But, it is down almost 19% on the few days, so it’s one of the primary losers regarding the greatest a hundred coins by market cap. “The new current rise within the BSC continuous amounts and you can DEX activity are not simply a passing stage,” Cecilia Hsueh, Chief Means Administrator at the crypto replace MEXC, advised Decrypt. Hyperliquid’s Hype is currently down 6.2% on the day, even if with market limit out of $a dozen.step 1 billion, they sits a lot more highest regarding the reviews while the twentieth biggest cryptocurrency.

The first decentralized transfers (DEX) have been minimal inside abilities and you will did not enable it to be trade having fun with restriction requests, such. First of all, it lacked the capability to change futures or discover-finished agreements. The fresh designers away from Hyperliquid solved this issue, and this welcome profiles to open up brief and you may long positions with cryptocurrencies personally due to a great decentralized system.

The brand new decentralized tissues in addition to minimizes regulatory chance, making the program a lot more resistant against geographic limits or rules alter very often effect centralized transfers. The platform tools a new burn device one takes away tokens out of stream according to trading hobby, performing deflationary tension which could help much time-label rates love. Change payment profits get transformed into Buzz and forever taken from also have, if you are liquidation charges and insurance finance payouts contribute additional burn volume throughout the industry volatility. The organization group includes alumni from Harvard, Caltech, and you may MIT, having elite group experience in the firms such Citadel and you can Hudson Lake Exchange.

See effortless definitions for preferred crypto investment paying terms, authored by the new Black-and-white team. Hyperliquid points is rewards gained because of the trade to your platform, that happen to be accustomed calculate users’ Buzz airdrop allotment in the genesis experience. Airdrops are very a greatest unit to possess DEXs to draw early adopters and Hyperliquid is not any exemption.

These types of deployments are essential to own enhancing the platform’s possibilities and you may making sure the alignment which have affiliate requires plus the most recent scientific improvements. The brand new Hyperliquid creators expected an excellent blockchain environment one to prioritizes overall performance, scalability, and you may decentralization. While you are particular information about the new Hyperliquid founders remain limited, the experience in blockchain technology and you will decentralized fund (DeFi) goes without saying in the type of the brand new Hyperliquid platform.