In the Defense Deposits

Content

Usually the one-day limitation ensures that a landlord don’t ask for last day’s book and you can a safety put. However, if your rent is actually renewed in the a greater number or the rent are enhanced inside the name of your own rent, the newest property manager try permitted to gather more cash regarding the occupant to carry the security deposit around the fresh month- https://vogueplay.com/uk/thrills-casino-review/ to-month rent. Landlords, regardless of the amount of equipment regarding the strengthening, have to remove the new deposits as the trust fund owned by their renters and they may well not co-mingle deposits using their very own currency. Lease stabilized clients provides a straight to a one- otherwise a few-seasons restoration book, and therefore should be for a passing fancy small print since the past lease, unless a positive change try required by the a certain law otherwise regulation.

Rental Defense Deposit Calculator Information

If the resident orders commissary which allotment is utilized before the resident’s commissary equilibrium. Like any other sites one manage economic advice, all of our webpages operates to your a great timeout to safeguard your sensitive and painful guidance. If an alternative web page isn’t loaded within ten full minutes, this site often start a log out on your bank account. While you are typing a lengthy message which takes place, when you simply click save or posting, your bank account will be signed aside as well as the message doesn’t save otherwise post. When writing a long current email address, we recommend composing the term in short chip including Notepad. Because the message is finished you could potentially log on to the fresh site, open a new content, and you will content/insert out of Notepad to your site.

. Tucoemas Borrowing from the bank Relationship

- With a credit card and you may managing it safely allows people to make a credit history and you may credit rating to get future sales.

- Consultative functions because of Atomic Purchase are made to assist clients inside reaching a good result inside their funding profile.

- If you aren’t a good GST/HST registrant, you can’t claim ITCs for the GST and/or government part of your HST you pay during importation.

- Enter into which password for many who be eligible for an automated a couple of-week expansion of time so you can file their government come back as you is actually out from the nation.

- However, a customers just who imports characteristics otherwise IPP to have application, have fun with otherwise likewise have 90% or even more in the a professional hobby does not afford the GST/HST.

The new non-citizen that is not joined under the typical GST/HST program doesn’t fees the customer which is entered less than the normal GST/HST regimen. The brand new registrant doesn’t costs the fresh low-resident the brand new GST/HST according of one’s supply of the products. Since the importer from number, the fresh non-resident brand will pay the brand new GST and/or federal an element of the HST if the shelves is actually brought in on the Canada. A keen unregistered low-citizen usually do not allege an ITC to your GST or even the federal the main HST repaid during the edging. From the delegating your rights for the discount, you can, in effect, purchase the goods, intangible property, otherwise characteristics without the newest GST/HST. There’s a typical example of a task out of legal rights contract for the GST/HST promotion.

Iowa Local rental Advice Apps

You need to done Setting They-280 and you will submit it together with your brand new return whenever registered. If you and your companion or former mate are not any expanded hitched, or is actually lawfully split, or have stayed aside at all times inside the a dozen-day period before the go out out of filing for save, you may also request a separation away from liability for delicate taxation on the a shared get back. An associate‑12 months resident of the latest York State who incurs losses regarding the resident or nonresident several months, otherwise one another, have to generate a new NOL computation for every several months (resident and you may nonresident), only using those things of cash, acquire, losses, otherwise deduction attributable to for each several months. On the resident several months, estimate the fresh NOL only using those things cash, get, losings, and you will deduction who were advertised in the event the a different government return is recorded to the age of Ny Condition residence.

Changes Cards Investment Chatting Membership

If you aren’t filing electronically, you might file their go back and then make the payment at the performing standard bank inside Canada. Some other online choice is to authorize the new CRA in order to withdraw an excellent pre-determined payment from the savings account to invest income tax on the a good certain date or dates. A financial institution that’s an excellent registrant and has yearly revenue of over $1 million will even basically have to file Mode GST111, Financial institution GST/HST Annual Information Go back, in this half a year of your own prevent of its fiscal year end, in addition to the normal GST/HST come back. For more information, come across Guide RC4419, Lender GST/HST Yearly Guidance Get back. Ahead of time using the small type of accounting, file an instant method election.

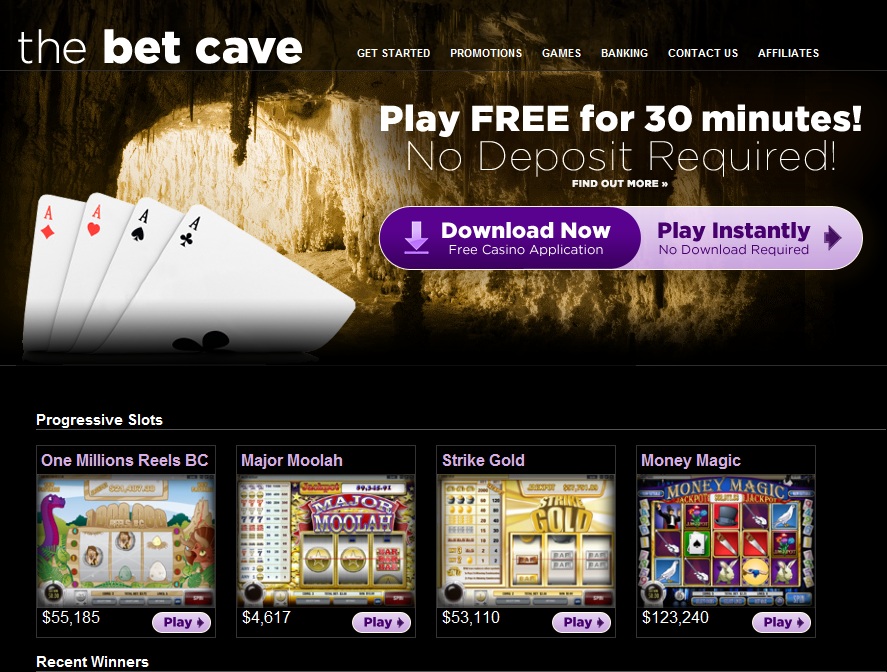

RealPrize Gambling establishment

On the Sleek Input Tax Borrowing from the bank Approach, you do not have to split up the level of the newest GST/HST payable on each invoice; instead, you only need to tune the total amount of the eligible nonexempt purchases. But not, you must independent the GST-taxable orders from your HST-taxable sales, and you have to keep common data to help with your ITC states if the CRA asks observe him or her. Concurrently, when you are a general public service looks, you truly must be capable relatively anticipate that the nonexempt requests in the present fiscal seasons won’t be over $cuatro million. If that’s the case, you could claim the individuals in past times unclaimed ITCs to the the next GST/HST get back. ITCs need to be stated from the due date of your own return for the last reporting several months you to comes to an end within number of years immediately after the conclusion the new revealing period in which the ITC you may provides earliest already been advertised.

Yet not, so it number won’t be an identical when you’re subject on the special accruals, both as the a full-seasons nonresident or region-season resident. Get into you to part of the government number one to represents nonexempt unemployment compensation you gotten since the a great nonresident because of a career in the The brand new York County. In case your jobless payment acquired away from Nyc County source is actually centered on salary or paycheck earnings made partially inside the and you will partly of Nyc State, determine the amount allocable so you can Ny Condition in identical trend because the salary and you may salary money about what it’s founded. Also add you to definitely part of the government number which you obtained as you had been a resident.

Exterior Nyc, book normalized rentals are found in structures that have half dozen or much more rentals that were centered before January step one, 1974. More often than not the organization are certain to get your order brought in this each week of one’s purchase. Should your acquisition hasn’t been introduced inside each week, delight simply click “Call us” and fill in the form. An excellent Commissary Allowance makes you offer a keen allocation to a good citizen rather than and make in initial deposit. So it allotment could only be used to own commissary and won’t be included in the newest resident’s commissary account.